We need to act now to protect investors and the global financial marketplace from the severe risks posed by crypto-assets and must not be distracted by technical obfuscations which mask an abject lack of technological utility. We thank you for your leadership on financial technology and regulation and urge you to consider our objective and independent expert judgments to guide your legislative priorities, which we remain happy to discuss anytime.

politics

Bitcoin crashes the midterms – POLITICO

Candidates are staking out positions on cryptocurrency, scrambling party lines and fanning fundraising concerns.

CSIRO says laws should be published in code

Commonwealth legislation should not only be published in words but in machine-readable code, which would allow it to be read not only by lawyers but also computers, a move CSIRO suggests will boost the adoption of new regulatory technology across the economy, improving compliance while reducing costs.

CSIRO detailed its vision for “rules as code” in a submission to the Senate select committee on financial and regulatory technology, calling for the government to think more about ‘legal informatics’, or ‘computational law’, to allow computers to help automate compliance. This would “reduce the cost of red tape and improve the quality of risk management in society,” the science agency said.

“The goal is that computer-assisted reasoning using these logics should give the same answers as judges and lawyers doing legal reasoning about the black-letter law,” CSIRO said. “When legal texts can be represented in this way, it enables the potential to build digital tools to help people to interact with the law.”

The banking industry – which has faced soaring compliance costs in the wake of the Hayne royal commission – has been wary about adopting new technologies in compliance. This has been due to the complexity of regulation, a reluctance by regulators to endorse a specific technological approach, and heavy sanctions for failures. This was evidenced by AUSTRAC’s legal actions for anti-money laundering failures at Commonwealth Bank and Westpac, which both related to failures in technology systems.

The big banks want Treasury to encourage the financial sector regulators ASIC, APRA and the Reserve Bank, “to make regtech a viable proposition in the financial services sector”.

Many start-ups, along with more established technology vendors, are developing new systems to help banks meet legal duties, including establishing the identity and background of customers, ensuring legal compliance, verification of income and expenses, and data privacy. Juniper Research expects global spending on regtech to rise from $US25 billion ($37 billion) 2019 to $US127 billion by 2024.

‘Rules as code’

CSIRO, which operates a digital innovation arm known as Data61, has detailed to the committee how a “rules as code” approach could lift compliance with various laws.

It is working with PwC on a joint venture called PaidRight to check employees’ entitlements under enterprise bargaining agreements against what they have actually been paid.

The banking industry and CSIRO are working on a project to develop a digital approach to organising climate change disclosure, which CSIRO said could be “a first step towards a nationally coordinated framework for delivery of climate information”.

The agency is also working with the building and construction industry to automatically check Computer Aided Design (CAD) models of buildings against the many building and construction regulations from the federal and state governments.

Publishing machine-interpretable rules alongside the text of legislation would “provide critical support for the regtech industry and potentially significant productivity benefits for regulated industries in Australia,” CSIRO said.

The Australian Banking Association called on the committee, which is being chaired by Liberal Senator Andrew Bragg, to recommend that Treasury “be explicitly tasked with responsibility for a growth strategy for regtech”.

Design box thinking

The RegTech Association, which represents 110 start-ups and corporates, suggested the committee call for the creation of a COAG-style forum to introduce government departments to regtech, and is encouraging government to become an “influencer, buyer, beneficiary and investor” in the space.

In its submission, the association suggests a percentage of regulatory fines paid by banks could be invested in a new ‘patient capital’ investment fund to invest in the sector, modelled on the Australian Medical Research Future Fund. It also reckons a safe harbour, or relief program, could be created to provide reporting entities attempting to deploy regtech with more confidence to adopt changes, via amendments to ASIC’s regulatory guidance.

The association also wants government to create “design box” or “sandbox” programs to accelerate testing of new technologies. It pointed to the APIX Platform, part of the ASEAN Financial Innovation Network and backed by the Monetary Authority of Singapore, which has created a marketplace for financial institutions to exchange ideas with fintechs on better ways of doing things.

“Australia could easily replicate this idea of a digital marketplace or partner to introduce a similar platform,” the association said.

“It could allow buyers and sellers to come together to experiment more easily, allow greater visibility over regtech solutions, help regtechs understand the current problem statements of their potential clients, and allow a ‘design box’ where negative assurance could be provided by regulators as observers. Over time the digital marketplace could also be a portal for talent and skill recruitment.”

Separately, CSIRO responded to an accusation in the submission by FinTech Australia to the inquiry which criticised Data61 for “competing directly with private enterprise for government and non-government work”. In a statement, CSIRO said it “does not seek to compete with the private sector or start-ups and where possible aims to partner with Australian organisations, to support their growth.

“Like many of CSIRO’s business units, projects for Data61, the digital innovation arm of CSIRO, are typically identified as a result of discussions with, or approaches from government, industry or academic partners, where an opportunity has been identified for our research to be applied to solve problems and create benefits for Australia.”

Inside the Congressional Staff Meeting About Libra

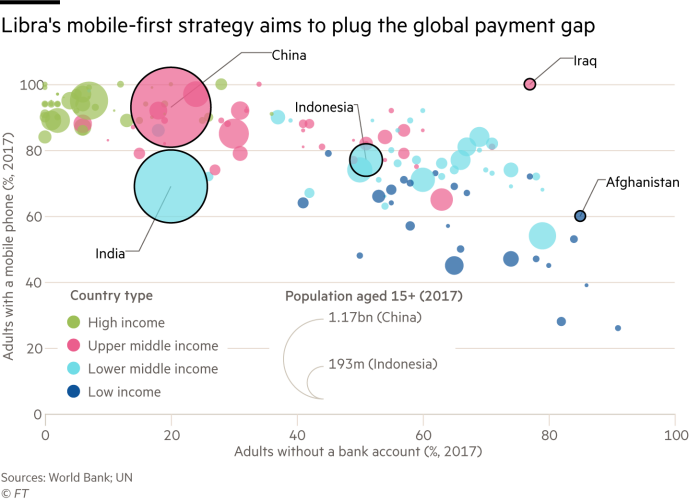

he briefing was fascinating. The lead representative, the head of policy for Libra, kicked it off by admitting that the whole endeavor required a “suspension of disbelief.” They were asked about the timeline, and said they hoped to have Libra operational in about a year, which they kept suggesting was a prolonged timeline, but didn’t seem lengthy to anyone in the room.They kept selling Libra as a means of providing banking services to 1.7 billion unbanked people around the world. When challenged on how they were going to do that, and asked directly whether they’d figure out how exactly a digital currency would be an answer for people who can’t access credit currently, they said, “The short answer is no.” The phrase “the miracle of blockchain” was used at one point.Facebook said that they assumed the FTC (Federal Trade Commission) or the CFPB (Consumer Financial Protection Bureau) would regulate Libra. Questions were asked about what basket of currency would be used and other practicalities, and the answers were fairly vague. Gemini, another cryptocurrency, was referred to as a “regulated exchange” because I guess there are 43 states that have some form of protections on it (with the implication being that that is adequate).We were assured that even if a Libra user used WhatsApp or Messenger, WhatsApp/Facebook would not access specific information about their transactions beyond that they were interested in or using Libra. That would of course be enough information to know a lot more about users.Another question asked was what protections were in place to prevent collusion between Libra’s 27 partners. The answer was that the partners were well aware of the “reputational risks” they might incur should they violate privacy laws, etc. It was also pointed out that some of the partners are direct competitors, as if that has ever prevented them from colluding in the past.Ultimately we need more than a briefing. Currency backed by reserves is coinage. Because Facebook is proposing to take over a role traditionally under the purview of central banks, not private companies, we should expect the skepticism we heard in the room from staffers to be publicly aired by House Financial Services Committee members on July 17.

Banks steer clear of Facebook’s Libra project | Financial Times

Banks steer clear of Facebook’s Libra project Traditional lenders are working on their own faster, cheaper payments projects Facebook’s Libra threatens to break down banks’ role as gatekeepers of the global financial system © FT montage Share on Twitter (opens new window) Share on Facebook (opens new window) Share on LinkedIn (opens new window) Save Save to myFT Laura Noonan and Robert Armstrong in New York, Nicholas Megaw and Stephen Morris in London 12 HOURS AGO Print this page41 US and European banks are steering clear of Libra, Facebook’s project for a new cryptocurrency, for fear of antagonising regulators and cannibalising their own digital currency projects In the two weeks since Facebook announced its plans for a new digital currency, there has been silence from the banks about a project that threatens to break down their role as gatekeepers of the global financial system. “We’re still learning what it is and trying to work out where we stand on it; are we an opponent, partner or do we ignore?,” said a person familiar with the approach to the project of one of the world’s biggest banks. Up and down Wall Street, the City of London and Europe’s financial centres, senior industry executives reel off a litany of hurdles to participation, while some also criticise the way Facebook has approached the project so far. No banks were on the initial list of 27 other partners for the Libra Association, which will oversee the currency, though David Marcus, who is leading the project at Facebook, said he wanted to “absolutely and strongly deny the fact that we’ve approached banks and banks have said no”. “We have had conversations with banks. We still have conversations with banks. And my expectation is that by the time this thing launches next year you will have banks that are going to be members of this,” he told the Information. Senior executives at banks, however, tell a different story. At least one bank, the Netherland’s ING, responded to Facebook’s initial contact with a polite “no thank you”. Several other senior executives said there would be big hurdles for their future involvement, either as active members of the Libra Association or by helping people to convert traditional money in and out of Libra coins. Mike Corbat, head of Citigroup, recently said that even though he was a “true believer” in cryptocurrencies and their underlying blockchain technology, Citi’s capacity to participate is constrained, “The challenge with cryptocurrencies is the opaqueness as to the sources of the money,” he said, referencing anti-money-laundering standards banks are held to. “It would be outside our ability to take or send those monies on behalf [of people who hold them].” Facebook’s Libra coin: the truth behind the hype Meanwhile, several banks are pushing ahead with projects to speed up payments, which some said would overtake the Libra initiative. Mastercard, which is part of the Libra project, is working with six Nordic banks to build a payments system that would allow real-time transfers, and be used across multiple currencies in multiple countries. Paul Stoddart, Mastercard’s president of new payment platforms, said he expected to see “more initiatives like this around the world where there are groups of countries or regions that are economically more tightly integrated”. In the US, The Clearing House, a payments company backed by a coalition of 25 large banks including JPMorgan Chase, Bank of America and Citigroup, offers domestic real-time payments on a network, launched in 2017, that already connects half of the country’s deposit accounts. And on June, 13 of the world’s biggest banks including UBS, Lloyds Banking Group and MUFG, announced plans to launch their own digital coin for use in wholesale banking. Recommended Libra: Facebook’s digital currency Will Facebook’s Libra currency shake up financial services? A senior executive at one of the banks involved said: “Facebook is right that cross-border payments are clunky and convoluted and you have to go through far too many counterparties, but banks are getting involved and will solve this problem and solve it pretty quickly.” The banks expect that the first institutional transaction with the “universal settlement coin” will take place within a year, and could be a cross-border trade. Meanwhile, the head of innovation at another US bank said the industry needed to understand a lot more, including the purpose of the Libra coin, the regulatory environment and the system’s technical underpinning before they could commit to the project. “We will be talking to them [Libra] very soon,” he said. “There’s a huge amount of scepticism but there’s some enormous names who have put up $10m a pop; there’s enough names of enough reputable organisations that have put up $10m to be a part of it to say there’s something there.” A senior executive at a third large US bank said he did not believe banks would have to lobby very hard to ensure that Libra attracts the same know-your-customer and anti-money-laundering scrutiny as traditional payments networks, which will heap costs on the project. “If this thing has the scale of 2bn people who can move money around outside of the financial system (without AML/KYC), it makes a mockery of the system,” he said. “We won’t have to persuade them in Washington . . . regulators are at it, they’ll make them lift to the same standards as everyone else.” The executive added that Facebook, which recently hired a prominent lobbyist from Standard Chartered, had already mishandled the regulatory piece by announcing their plans without having first brought regulators onside. Who is backing Libra so far? Payments Mastercard, PayPal, PayU, Stripe, Visa Tech and consumer Booking Holdings, eBay, Facebook, Farfetch, Lyft, Mercado Pago, Spotify, Uber Telecoms Iliad, Vodafone Blockchain Anchorage, Bison Trails, Coinbase, Xapo Holdings Venture Capital Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, Union Square Ventures NGOs Creative Destruction Lab, Kiva, Mercy Corps, Women’s World Banking When JPMorgan Chase drew up plans for a much more limited digital coin, they had extensive conversations with regulators before going public, asking them for informal guidance on what would be acceptable to them, a person close to that process said. The Trump administration’s financial regulation regime is much more amenable to those iterative conversations than the Obama administration, which “saw banks as the enemy”, he added. The head of innovation of a large European bank said its participation was hampered by the fact that “regulations don’t allow us to be very entrepreneurial in this area”. Mr Marcus acknowledged the regulatory concerns in a blog post on Wednesday. He promised a “collaborative process” with regulators, and said replacing cash with a digital network “with regulated on and off ramps with proper know-your-customer practices” could help limit financial crime. A senior executive at a fourth large US bank said his company might still participate but there was a long road ahead. “The money [initial $10m investment] over here wouldn’t be the most material hurdles, they [the sums] are not big among in the scheme of things,” he said. The test would be whether it is “regulated, and is it really solving a problem or just ticking a quasi-innovation box, we’d need to be comfortable with the use cases, what they would do beyond regulation, regulation is like a minimum bar”. For some banks, even ticking all those boxes will not go far enough. “You could argue it’s a competitor to our competitive advantage . . . the ability to move money around the world for customers within our network. So it would be rather unusual to go outside that, to compete against yourself, in many ways.”

Source: Banks steer clear of Facebook’s Libra project | Financial Times

Regulators Have Doubts About Facebook Cryptocurrency. So Do Its Partners. – The New York Times

One of the biggest selling points of Facebook’s ambitious plans for its new cryptocurrency, Libra, was that the social media company had 27 partners, including prominent outfits like Visa, Mastercard and Uber, helping out on the project.But some of those partners are approaching Libra warily. They signed nonbinding agreements to join the effort partly because they knew they weren’t obliged to use or promote the digital token and could easily back out if they didn’t like where it was going, said executives at seven of those companies, who spoke on the condition of anonymity because of the sensitivity of the negotiations.The doubts among Facebook’s partners add to a growing list of challenges for Libra, a new digital token that Facebook executives hope will one day become the foundation for a new kind of online financial industry.Interested in All Things Tech?The Bits newsletter will keep you updated on the latest from Silicon Valley and the technology industry.Companies are hesitant to associate themselves too closely with the Libra project because of Facebook’s issues with regulators around the world, the company’s shaky track record on privacy and how it treats corporate partners, and the uncertain legality of cryptocurrencies.Maxine Waters, the chairwoman of the House Financial Services Committee, has scheduled a hearing on the Libra cryptocurrency.CreditErin Schaff/The New York TimesImageMaxine Waters, the chairwoman of the House Financial Services Committee, has scheduled a hearing on the Libra cryptocurrency.Maxine Waters, the chairwoman of the House Financial Services Committee, has scheduled a hearing on the Libra cryptocurrency.CreditErin Schaff/The New York TimesThough it was announced just a week ago, the Libra effort has already drawn scrutiny in Washington. Maxine Waters, the chairwoman of the House Financial Services Committee and a Democrat from California, quickly scheduled hearings to examine Libra and told Facebook to stop development of the project until big questions are answered.The House hearing is set for July 17. The Senate is expected to hold a hearing on the same issue the day before.Jerome H. Powell, chairman of the Federal Reserve, said on Tuesday that the central bank would be looking at Libra “very carefully” given its potential scale. “I think that our expectations from a consumer protection standpoint, from a regulatory standpoint, are going to be very, very high,” Mr. Powell said at an event at the Council on Foreign Relations in New York.European regulators have also asked for more details about the project.Facebook said the 27 partners that it announced last week were giving at least $10 million and joining an association that would govern the Libra cryptocurrency, which is set to be introduced next year.Editors’ PicksWhen You’re Told You’re Too Fat to Get PregnantGiant Squid Reappears on Video, This Time in U.S. WatersWhen ISIS Killed Cyclists on Their Journey Around the WorldBut no money has changed hands so far. A number of partners said they would decide whether to join the association and make the payment after there is more clarity on how Libra will work, the executives from the seven companies said.A Facebook spokeswoman, Elka Looks, said in a statement that the company plans “to engage in healthy dialogue and debate with our fellow founding members, and to welcoming additional members over the coming months.”“We know this will take time and it won’t be easy, but together we will be able to make the Libra mission a reality,” Ms. Looks said.A spokesman for the Libra Association, Dante Disparte, said that since the announcement last week, the association has heard from a flood of companies interested in being members. He said the association, which will manage Libra, will most likely have a waiting list for those wanting to be among the 100 initial members it hopes to start with next year.Facebook had hoped its partners could help Libra handle some of the critics and give the project some distance from the social networking giant and its recent legal problems. But even before the project began, potential partners had their own concerns.Facebook approached a number of big financial companies, including Goldman Sachs, JPMorgan Chase and Fidelity, about participating in the project, according to two people briefed on the discussions. The financial companies declined to join, in part because of regulatory questions about cryptocurrencies, the people said.Press officers for the banks all declined to comment. A spokeswoman for Fidelity said the company was continuing to monitor the project.

Source: Regulators Have Doubts About Facebook Cryptocurrency. So Do Its Partners. – The New York Times

Facebook Token Runs Into Instant Political Opposition in Europe

Facebook Inc.’s ambitious plan to roll out its own cryptocurrency ran into immediate political opposition in Europe, with calls for tighter regulation of the social-media giant.

French Finance Minister Bruno Le Maire said the digital currency known as Libra shouldn’t be seen as a replacement for traditional currencies.

“It is out of question’’ that Libra “become a sovereign currency,’’ Le Maire said in an interview on Europe 1 radio. “It can’t and it must not happen.”

Read more about Facebook’s cryptocurrency plan

Le Maire called on the Group of Seven central bank governors, guardians of the global monetary system, to prepare a report on Facebook’s project for their July meeting. His concerns include privacy, money laundering and terrorism finance.

Libra was also a talking point at the European Central Bank’s annual symposium in Sintra, Portugal, where Bank of England Governor Mark Carney referenced Libra. “Anything that works in this world will become instantly systemic and will have to be subject to the highest standards off regulation,” he said.

Carney’s ‘Open Mind’

While Carney said “we need to have an open mind” about technology that can facilitate cross-border money transfers, “we will look at it very closely and in a coordinated fashion” at multilateral organizations including the G-7, the International Monetary Fund, Bank for International Settlements and Financial Stability Board.

Meanwhile, Markus Ferber, a German member of the European Parliament, said Facebook, with more than 2 billion users, could become a “shadow bank” and that regulators should be on high alert.

Facebook is developing Libra, a stablecoin designed to avoid the volatility of Bitcoin and thus be useful for commerce, in partnership with some of the biggest names in payments and technology, such as Visa Inc. and Uber Technologies Inc. The new currency, which will launch as soon as next year, is pegged to a basket of government-backed currencies and securities.

While Bitcoin, the original cryptocurrency, has attracted a lot of attention since its creation a decade ago, it’s still not widely used beyond market speculation. Facebook meanwhile, plans to build a new digital wallet that will exist in its Messenger and WhatsApp services to make it easy for people to send money to friends, family and businesses through the apps.

“This money will allow this company to assemble even more data, which only increases our determination to regulate the internet giants,” Le Maire said in parliament.

Texts adopted – Blockchain: a forward-looking trade policy – Thursday, 13 December 2018

Texts adopted – Distributed ledger technologies and blockchains: building trust with disintermediation – Wednesday, 3 October 2018

Cashing In: How to Make Negative Interest Rates Work – IMF Blog

Many central banks reduced policy interest rates to zero during the global financial crisis to boost growth. Ten years later, interest rates remain low in most countries. While the global economy has been recovering, future downturns are inevitable. Severe recessions have historically required 3–6 percentage points cut in policy rates. If another crisis happens, few countries would have that kind of room for monetary policy to respond.To get around this problem, a recent IMF staff study shows how central banks can set up a system that would make deeply negative interest rates a feasible option.

Source: Cashing In: How to Make Negative Interest Rates Work – IMF Blog