Bitcoin conspiracy theorists have long suspected the U.S. government, among others, would like to shut down bitcoin.Bitcoin’s first decade has seen its price explode, making early adopters overnight millionaires, and prompting some of the world’s biggest technology companies to create their own versions of bitcoin.Now, it’s been revealed federal prosecutor-turned bitcoin and cryptocurrency expert Katie Haun was asked to look into “shutting down” bitcoin by her boss at the U.S. attorney’s office in 2012.

Libra

Facebook’s New Currency Has Big Claims and Bad Ideas – Foreign Policy

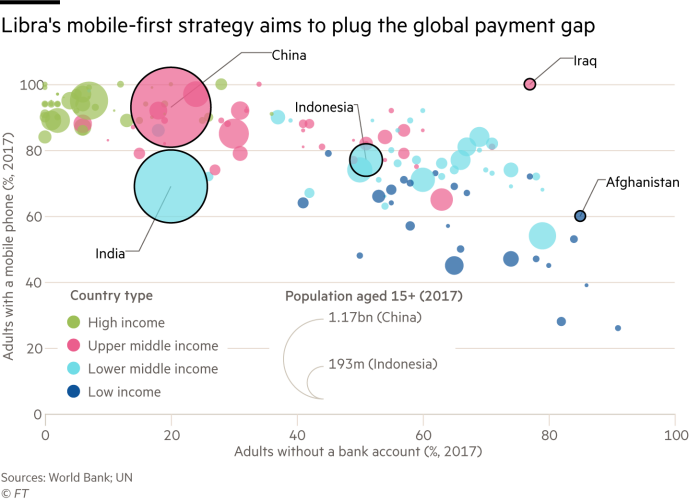

David Marcus, the Facebook executive in charge of the project, told the press last week that the problems of banking the unbanked were technical — that banks were unable to move money fast enough without a blockchain. This is completely backward. Experts know how to move numbers on a computer. The slow part is settlement and compliance: making sure that money transmitters are solvent, honest, and not fronting for drug runners. Banking the unbanked is a slow, one-on-one social process. Libra’s public relations material describes this as if it were entirely a technical problem — and none of it is.The real motivation for the project seems to be ideological. Marcus was formerly at PayPal, and he understands payments and regulation. But he’s been a bitcoin fan since 2012 and was on the board of the cryptocurrency exchange Coinbase in 2017.Marcus had been thinking about something like Libra for several years and had discussed the project with Facebook CEO Mark Zuckerberg since January 2018. Zuckerberg was interested in the project and the ideas—“a high-quality medium of exchange for the world, on a blockchain that could scale,” as Marcus described it in a press conference on June 17.Facebook is under increasingly close attention from governments deeply suspicious of its track record on privacy, election manipulation, and fake information and its repeated defiance of calls to appear before elected representatives. Yet Facebook and its closest partners seem to think that they are large and powerful enough to swing a coup against the concept of government control of money. Libra directly states that its intent is “to shape a regulatory environment” —not to comply with the existing regulatory environment. Regulators will need to bend to Libra.The Libra token is a foreign exchange derivative, synthesized from a basket of national currencies. Libra wants to operate as a shadow bank, issuing Libra-denominated liabilities that are explicitly intended to function as money. Libra “will create a mirror banking system using your money,” said Carlos Maslatón, the head of treasury at the bitcoin payments provider Xapo, explaining the service in a private WhatsApp chat group.Libra seems to be particularly targeting countries with lots of Facebook users and unstable currencies—the other meaning of banking the unbanked. There are obvious money-laundering hazards. “Know your customer” (KYC) rules require anyone dealing in currency substitutes to track the sources of funds so as to cut off funding for criminals and terrorists. Libra says it will keep to the highest of KYC standards—but a Libra partner in a bad economy risks compromising the compliance of the whole Libra system, given that its intent is to move money around the world at the speed of cryptocurrencies. Libra will need to keep this tight and assure developed-world regulators that it has done so, or it will place the entire Libra system at risk.

Source: Facebook’s New Currency Has Big Claims and Bad Ideas – Foreign Policy

Inside the Congressional Staff Meeting About Libra

he briefing was fascinating. The lead representative, the head of policy for Libra, kicked it off by admitting that the whole endeavor required a “suspension of disbelief.” They were asked about the timeline, and said they hoped to have Libra operational in about a year, which they kept suggesting was a prolonged timeline, but didn’t seem lengthy to anyone in the room.They kept selling Libra as a means of providing banking services to 1.7 billion unbanked people around the world. When challenged on how they were going to do that, and asked directly whether they’d figure out how exactly a digital currency would be an answer for people who can’t access credit currently, they said, “The short answer is no.” The phrase “the miracle of blockchain” was used at one point.Facebook said that they assumed the FTC (Federal Trade Commission) or the CFPB (Consumer Financial Protection Bureau) would regulate Libra. Questions were asked about what basket of currency would be used and other practicalities, and the answers were fairly vague. Gemini, another cryptocurrency, was referred to as a “regulated exchange” because I guess there are 43 states that have some form of protections on it (with the implication being that that is adequate).We were assured that even if a Libra user used WhatsApp or Messenger, WhatsApp/Facebook would not access specific information about their transactions beyond that they were interested in or using Libra. That would of course be enough information to know a lot more about users.Another question asked was what protections were in place to prevent collusion between Libra’s 27 partners. The answer was that the partners were well aware of the “reputational risks” they might incur should they violate privacy laws, etc. It was also pointed out that some of the partners are direct competitors, as if that has ever prevented them from colluding in the past.Ultimately we need more than a briefing. Currency backed by reserves is coinage. Because Facebook is proposing to take over a role traditionally under the purview of central banks, not private companies, we should expect the skepticism we heard in the room from staffers to be publicly aired by House Financial Services Committee members on July 17.

Banks steer clear of Facebook’s Libra project | Financial Times

Banks steer clear of Facebook’s Libra project Traditional lenders are working on their own faster, cheaper payments projects Facebook’s Libra threatens to break down banks’ role as gatekeepers of the global financial system © FT montage Share on Twitter (opens new window) Share on Facebook (opens new window) Share on LinkedIn (opens new window) Save Save to myFT Laura Noonan and Robert Armstrong in New York, Nicholas Megaw and Stephen Morris in London 12 HOURS AGO Print this page41 US and European banks are steering clear of Libra, Facebook’s project for a new cryptocurrency, for fear of antagonising regulators and cannibalising their own digital currency projects In the two weeks since Facebook announced its plans for a new digital currency, there has been silence from the banks about a project that threatens to break down their role as gatekeepers of the global financial system. “We’re still learning what it is and trying to work out where we stand on it; are we an opponent, partner or do we ignore?,” said a person familiar with the approach to the project of one of the world’s biggest banks. Up and down Wall Street, the City of London and Europe’s financial centres, senior industry executives reel off a litany of hurdles to participation, while some also criticise the way Facebook has approached the project so far. No banks were on the initial list of 27 other partners for the Libra Association, which will oversee the currency, though David Marcus, who is leading the project at Facebook, said he wanted to “absolutely and strongly deny the fact that we’ve approached banks and banks have said no”. “We have had conversations with banks. We still have conversations with banks. And my expectation is that by the time this thing launches next year you will have banks that are going to be members of this,” he told the Information. Senior executives at banks, however, tell a different story. At least one bank, the Netherland’s ING, responded to Facebook’s initial contact with a polite “no thank you”. Several other senior executives said there would be big hurdles for their future involvement, either as active members of the Libra Association or by helping people to convert traditional money in and out of Libra coins. Mike Corbat, head of Citigroup, recently said that even though he was a “true believer” in cryptocurrencies and their underlying blockchain technology, Citi’s capacity to participate is constrained, “The challenge with cryptocurrencies is the opaqueness as to the sources of the money,” he said, referencing anti-money-laundering standards banks are held to. “It would be outside our ability to take or send those monies on behalf [of people who hold them].” Facebook’s Libra coin: the truth behind the hype Meanwhile, several banks are pushing ahead with projects to speed up payments, which some said would overtake the Libra initiative. Mastercard, which is part of the Libra project, is working with six Nordic banks to build a payments system that would allow real-time transfers, and be used across multiple currencies in multiple countries. Paul Stoddart, Mastercard’s president of new payment platforms, said he expected to see “more initiatives like this around the world where there are groups of countries or regions that are economically more tightly integrated”. In the US, The Clearing House, a payments company backed by a coalition of 25 large banks including JPMorgan Chase, Bank of America and Citigroup, offers domestic real-time payments on a network, launched in 2017, that already connects half of the country’s deposit accounts. And on June, 13 of the world’s biggest banks including UBS, Lloyds Banking Group and MUFG, announced plans to launch their own digital coin for use in wholesale banking. Recommended Libra: Facebook’s digital currency Will Facebook’s Libra currency shake up financial services? A senior executive at one of the banks involved said: “Facebook is right that cross-border payments are clunky and convoluted and you have to go through far too many counterparties, but banks are getting involved and will solve this problem and solve it pretty quickly.” The banks expect that the first institutional transaction with the “universal settlement coin” will take place within a year, and could be a cross-border trade. Meanwhile, the head of innovation at another US bank said the industry needed to understand a lot more, including the purpose of the Libra coin, the regulatory environment and the system’s technical underpinning before they could commit to the project. “We will be talking to them [Libra] very soon,” he said. “There’s a huge amount of scepticism but there’s some enormous names who have put up $10m a pop; there’s enough names of enough reputable organisations that have put up $10m to be a part of it to say there’s something there.” A senior executive at a third large US bank said he did not believe banks would have to lobby very hard to ensure that Libra attracts the same know-your-customer and anti-money-laundering scrutiny as traditional payments networks, which will heap costs on the project. “If this thing has the scale of 2bn people who can move money around outside of the financial system (without AML/KYC), it makes a mockery of the system,” he said. “We won’t have to persuade them in Washington . . . regulators are at it, they’ll make them lift to the same standards as everyone else.” The executive added that Facebook, which recently hired a prominent lobbyist from Standard Chartered, had already mishandled the regulatory piece by announcing their plans without having first brought regulators onside. Who is backing Libra so far? Payments Mastercard, PayPal, PayU, Stripe, Visa Tech and consumer Booking Holdings, eBay, Facebook, Farfetch, Lyft, Mercado Pago, Spotify, Uber Telecoms Iliad, Vodafone Blockchain Anchorage, Bison Trails, Coinbase, Xapo Holdings Venture Capital Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, Union Square Ventures NGOs Creative Destruction Lab, Kiva, Mercy Corps, Women’s World Banking When JPMorgan Chase drew up plans for a much more limited digital coin, they had extensive conversations with regulators before going public, asking them for informal guidance on what would be acceptable to them, a person close to that process said. The Trump administration’s financial regulation regime is much more amenable to those iterative conversations than the Obama administration, which “saw banks as the enemy”, he added. The head of innovation of a large European bank said its participation was hampered by the fact that “regulations don’t allow us to be very entrepreneurial in this area”. Mr Marcus acknowledged the regulatory concerns in a blog post on Wednesday. He promised a “collaborative process” with regulators, and said replacing cash with a digital network “with regulated on and off ramps with proper know-your-customer practices” could help limit financial crime. A senior executive at a fourth large US bank said his company might still participate but there was a long road ahead. “The money [initial $10m investment] over here wouldn’t be the most material hurdles, they [the sums] are not big among in the scheme of things,” he said. The test would be whether it is “regulated, and is it really solving a problem or just ticking a quasi-innovation box, we’d need to be comfortable with the use cases, what they would do beyond regulation, regulation is like a minimum bar”. For some banks, even ticking all those boxes will not go far enough. “You could argue it’s a competitor to our competitive advantage . . . the ability to move money around the world for customers within our network. So it would be rather unusual to go outside that, to compete against yourself, in many ways.”

Source: Banks steer clear of Facebook’s Libra project | Financial Times

Libra: US Congress asks Facebook to pause development | Technology | The Guardian

The US Congress has asked Facebook to pause development on its Libra cryptocurrency until lawmakers have had more time to investigate the ramifications of the company’s actions.In a letter from the Democratic heads of the house committee on financial services and its subcommittees, the legislators ask the company to “immediately cease implementation plans”.“Because Facebook is already in the hands of over a quarter of the world’s population, it is imperative that Facebook and its partners immediately cease implementation plans until regulators and Congress have an opportunity to examine these issues and take action,” the letter says.“During this moratorium, we intend to hold public hearings on the risks and benefits of cryptocurrency-based activities and explore legislative solutions. Failure to cease implementation before we can do so risks a new Swiss-based financial system that is too big to fail.”

Source: Libra: US Congress asks Facebook to pause development | Technology | The Guardian

Antitrust regulators may also scrutinize internet firms’ cryptocurrencies: German cartel chief – Reuters

BONN, Germany (Reuters) – Cryptocurrencies backed by big internet companies could come under the scrutiny of antitrust regulators, the head of Germany’s Federal Cartel Office said on Thursday after Facebook last week launched its own version.Central bankers and financial watchdogs were quick to raise concerns about Facebook’s planned Libra global cryptocurrency, saying that it could become so pervasive as to disrupt the global monetary policy framework.Germany’s antitrust watchdog’s president Andreas Mundt, who has pursued the world’s largest social network over other areas of its business, told reporters that cryptocurrencies launched by companies like Facebook “could become a topic for us”.Mundt has taken Facebook to task over its handling of data collected from users of the social network and its messaging apps without their consent, finding the firm founded by CEO Mark Zuckerberg abused its market dominance.

Regulators Have Doubts About Facebook Cryptocurrency. So Do Its Partners. – The New York Times

One of the biggest selling points of Facebook’s ambitious plans for its new cryptocurrency, Libra, was that the social media company had 27 partners, including prominent outfits like Visa, Mastercard and Uber, helping out on the project.But some of those partners are approaching Libra warily. They signed nonbinding agreements to join the effort partly because they knew they weren’t obliged to use or promote the digital token and could easily back out if they didn’t like where it was going, said executives at seven of those companies, who spoke on the condition of anonymity because of the sensitivity of the negotiations.The doubts among Facebook’s partners add to a growing list of challenges for Libra, a new digital token that Facebook executives hope will one day become the foundation for a new kind of online financial industry.Interested in All Things Tech?The Bits newsletter will keep you updated on the latest from Silicon Valley and the technology industry.Companies are hesitant to associate themselves too closely with the Libra project because of Facebook’s issues with regulators around the world, the company’s shaky track record on privacy and how it treats corporate partners, and the uncertain legality of cryptocurrencies.Maxine Waters, the chairwoman of the House Financial Services Committee, has scheduled a hearing on the Libra cryptocurrency.CreditErin Schaff/The New York TimesImageMaxine Waters, the chairwoman of the House Financial Services Committee, has scheduled a hearing on the Libra cryptocurrency.Maxine Waters, the chairwoman of the House Financial Services Committee, has scheduled a hearing on the Libra cryptocurrency.CreditErin Schaff/The New York TimesThough it was announced just a week ago, the Libra effort has already drawn scrutiny in Washington. Maxine Waters, the chairwoman of the House Financial Services Committee and a Democrat from California, quickly scheduled hearings to examine Libra and told Facebook to stop development of the project until big questions are answered.The House hearing is set for July 17. The Senate is expected to hold a hearing on the same issue the day before.Jerome H. Powell, chairman of the Federal Reserve, said on Tuesday that the central bank would be looking at Libra “very carefully” given its potential scale. “I think that our expectations from a consumer protection standpoint, from a regulatory standpoint, are going to be very, very high,” Mr. Powell said at an event at the Council on Foreign Relations in New York.European regulators have also asked for more details about the project.Facebook said the 27 partners that it announced last week were giving at least $10 million and joining an association that would govern the Libra cryptocurrency, which is set to be introduced next year.Editors’ PicksWhen You’re Told You’re Too Fat to Get PregnantGiant Squid Reappears on Video, This Time in U.S. WatersWhen ISIS Killed Cyclists on Their Journey Around the WorldBut no money has changed hands so far. A number of partners said they would decide whether to join the association and make the payment after there is more clarity on how Libra will work, the executives from the seven companies said.A Facebook spokeswoman, Elka Looks, said in a statement that the company plans “to engage in healthy dialogue and debate with our fellow founding members, and to welcoming additional members over the coming months.”“We know this will take time and it won’t be easy, but together we will be able to make the Libra mission a reality,” Ms. Looks said.A spokesman for the Libra Association, Dante Disparte, said that since the announcement last week, the association has heard from a flood of companies interested in being members. He said the association, which will manage Libra, will most likely have a waiting list for those wanting to be among the 100 initial members it hopes to start with next year.Facebook had hoped its partners could help Libra handle some of the critics and give the project some distance from the social networking giant and its recent legal problems. But even before the project began, potential partners had their own concerns.Facebook approached a number of big financial companies, including Goldman Sachs, JPMorgan Chase and Fidelity, about participating in the project, according to two people briefed on the discussions. The financial companies declined to join, in part because of regulatory questions about cryptocurrencies, the people said.Press officers for the banks all declined to comment. A spokeswoman for Fidelity said the company was continuing to monitor the project.

Source: Regulators Have Doubts About Facebook Cryptocurrency. So Do Its Partners. – The New York Times

Institute of Network Cultures | Rachel O’ Dwyer: The Bank of Facebook

Of course, all of this might come to nothing. This isn’t the first time that Facebook has attempted to launch a digital wallet. See a recent Financial Times article for more details on the specific regulatory hurdles that the cryptocurrency may face when a company the size of Facebook try to take on the banks. A proliferation of speculative ICOs and even Bitcoin might be one thing, but when a force the size of Facebook enters this space, significant financial regulation surely won’t be far behind. And finally, who knows, Libra might also be the mainstream push that actually empowers people to engage with less mainstream alternatives as more than speculative instruments, normalising alternative forms of money for users who are still unfamiliar with the technology. But probably not.

Source: Institute of Network Cultures | Rachel O’ Dwyer: The Bank of Facebook

Facebook enters dangerous waters with Libra cryptocurrency | Financial Times

Last week, the Bank of England released the result of an independent review of the future of finance, together with its response. As if to prove the importance of these issues, Facebook and 27 partners announced a plan for a global digital currency to be called Libra, and an associated payment system. How should one assess the significance, promise and risks of these developments? How should the regulators react? The answer is: with caution.

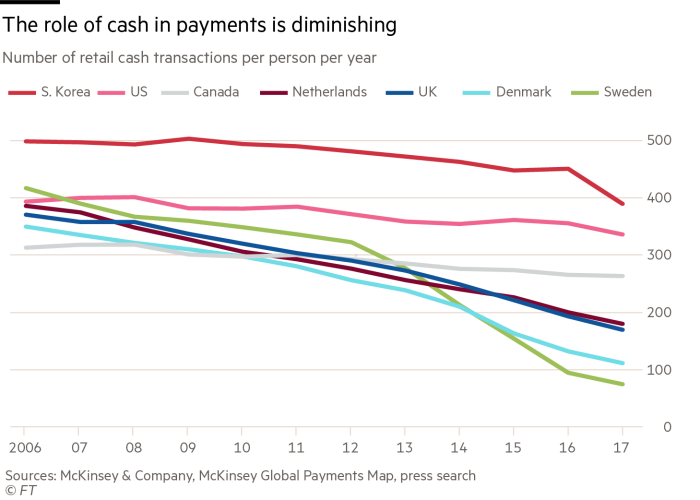

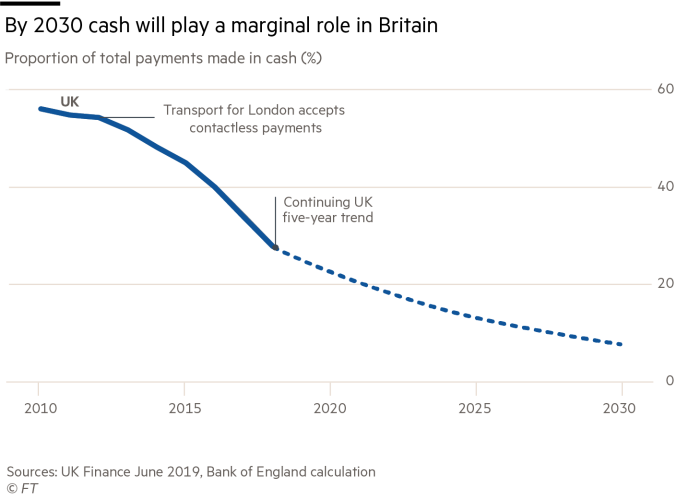

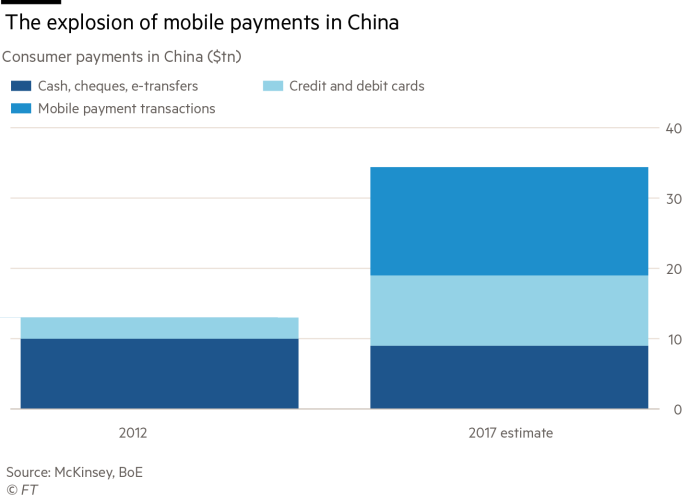

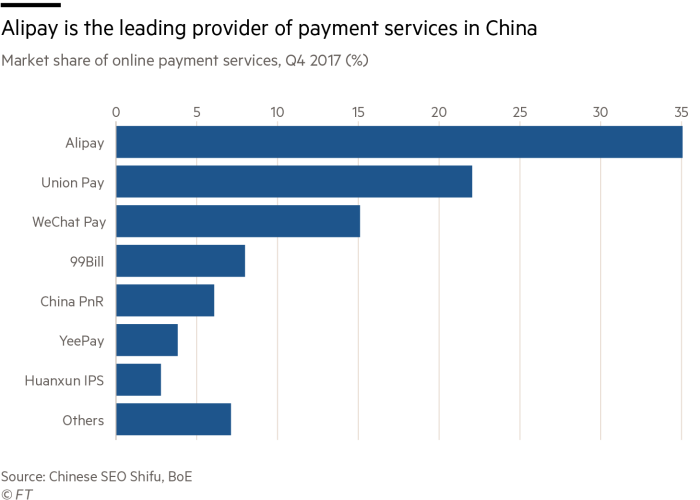

The information revolution, now augmented by artificial intelligence, will surely revolutionise finance. It offers huge potential benefits, in the form of faster and cheaper payments, superior financial services and better risk management. Already, we see a marked decline in the use of cash and explosive growth in digital payments. In China, the revolution in payment technology, led by Alipay (now part of Ant Financial) is extraordinary. Facebook is trying to create a rival. Note: the US is here following China.

Yet finance is also a critical infrastructure. A financial breakdown is likely to create a huge economic crisis. Ill-understood innovation has often proved a midwife of such calamities. It is vital therefore to ensure that the implications of big innovations, such as Libra,are understood. Mark Carney, governor of the BoE, argued last week in his Mansion House speech that the bank “approaches Libra with an open mind but not an open door”. The mind cannot be entirely open, however.

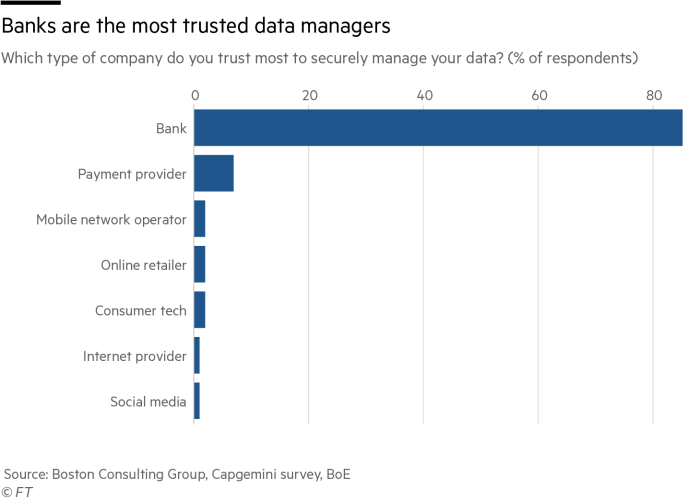

A first question must be whether we can trust the sponsor of so sensitive an innovation. Facebook has been grossly irresponsible over its impact on our democracies. It cannot obviously be trusted with our payments systems. Facebook has an answer: it has just one vote in the Libra Association, which will have independent governance located in Geneva. The aim is to have 100 members by the launch in 2020. But Facebook seems likely to dominate Libra’s technical development. That will surely give it predominant influence.

Randal Quarles, chairman of the Financial Stability Board, is right to tell leaders of the G20 nations, meeting in Japan, that “a wider use of new types of cryptoassets for retail payment purposes would warrant close scrutiny by authorities to ensure that they are subject to high standards of regulation”.

Thus, quite apart from doubts about the sponsor, a new global payment system must be evaluated for its technical stability, impact on monetary and financial stability (not least in developing countries) and openness to fraudsters, criminals and terrorists. Big questions also arise about concentrations of power, should the venture succeed.

Today’s plan is only for a payment system. The currency itself is, in the words of the Libra white paper, to be “fully backed by a reserve of real assets. A basket of bank deposits and short-term government securities will be held in the Libra Reserve for every Libra that is created, building trust in its intrinsic value.” That value will, however, be vulnerable to foreign exchange fluctuations and financial shocks (including exchange controls). Its movements relative to currencies could disturb users. Regulators will have to assess the instabilities associated with such a system.

I cannot judge the technical stability of the proposed system. The claim that it is based on “blockchain” technology seems rather questionable. But only fanatical supporters of “permissionless” systems need worry about that. What matters most is that the system is robust, resistant to breaches and protects personal privacy, while being sufficiently transparent to regulators, judicial authorities and others with a legitimate interest in who uses it.

A crucial issue is how Libra would interact with traditional banks. It might deprive them of a large proportion of their customers, on the payments side. Instead, the Libra system might hold huge deposits in the banks, matched, on the other side of its balance sheets, by customers’ holdings of Libra.

Alternatively, as Mr Carney said: “As new payment providers and systems emerge, access to the [BoE’s] core infrastructure should change and it makes sense to consider whether they too can hold funds overnight on the bank’s balance sheet.” To the extent that central banks create these reserves (a decision they alone make), a system like Libra might circumvent the traditional bank-based payment systems altogether. The historic advantages of banks as informed lenders might disappear.

A far more significant possibility emerges: the Libra system, with its knowledge of customers, would become a lender itself, thereby usurping traditional banks on the asset side of their balance sheets. At worst, the world might have a Facebook-dominated mono-bank. The risks of that are huge: potential monetary and financial instability, concentrated economic and political power, lack of privacy and many other issues. A global currency, created by the lending of a global bank (since banks create money as a byproduct of their loans), in a currency (the Libra) not backed by any central bank, and with no dominant regulator, seems to create a nightmarish risk to stability.

There is indeed potential for greatly improved payment systems. But the emergence of a payment system on a network of Facebook’s scale would raise some huge questions. Should Libra ultimately develop into a true banking system, with the capacity to create its own fiat (man-made) currency, the questions would become yet more pressing. Even if lending by the Libra system is ruled out, regulators should not allow this plan to go ahead without fully understanding the implications. This would be true even if the lead sponsor were not Facebook. But it is. So beware.

Source: Facebook enters dangerous waters with Libra cryptocurrency | Financial Times

Libra, a Cyberpunk Nightmare in the Midst of Crypto Spring

And make no mistake, love it or hate it, Libra is a big announcement.

A few years ago the idea that a major corporation would release a cryptocurrency was laughable, much less a consortium of gigantic multinationals releasing one, including stalwarts of the old world financial system like Visa and MasterCard.

But it’s bigger than that. It’s a turning point in monetary history.

It’s an ELE, an Extinction Level Event for the old financial world order. When historians look back they may just point to this moment as the catalyst.

But what does the future look like? How does it all play out?

Are we racing towards a financial renaissance or a cyberpunk nightmare of oligarchical mega-corporations ripped from the pages of William Gibson?

To find out, I do what I do always do, dive in head first and start reading and listening. I connected with people all over the community, asked my patrons to send me the best articles they could find, and I read Facebook’s whitepaper and the corporate propaganda (aka marketing).

What did I find?

Come with me as I show you a brave new world of digital currencies and an all-out war between the titans of industry and the massive nation-states of the modern world.

Eyes Wide Shut and Empire of Tomorrow

To start with, while I’m not afraid to eviscerate what I despise about Libra, I absolutely refuse to throw the baby out with the bathwater.

Just because I hate many aspects of this platform, doesn’t mean there’s not a lot to love.

And there’s a lot the crypto community can learn by paying close attention to what Facebook did here even if this all plays out like a bad episode of Mr. Robot and E-Corp brought to life.

They delivered on three of the five keys to crypto evolution, namely scale, distribution and the killer app. That alone might be enough to conquer the known world.

They also added a few more innovations pulled from the best of the best projects out there.

We’ll start with the user experience. Let’s face it, the user experience in crypto is utterly hideous. Crypto apps are almost universally ugly and impossible to use for the average person. They’re even hard to use for engineers. Early versions of Netscape were better looking.

Crypto apps will never work like this in the future:

You go to an exchange, sign up, get logged in, verify your account, get KYCed, set up two factor authentication, wire in fiat money, buy some crypto, download a wallet, and then load up a wallet just so you can download and use a decentralized version of Instagram to look at cat pictures.

It just cannot work that way for regular people. Try getting your mom into crypto. If you can do it in less than two weeks you’re a genius. This was never the path to global user adoption.

Without a better UX, crypto won’t even get out of the gate.

In 2017, I pointed to WeChat and its ubiquitous mobile messaging platform as the interface of the future. A lot of big crypto project builders came to the same conclusion. We saw Status raise $100 million. Telegram raised a whopping $1.7 billion privately to build their next generation blockchain, messaging and mobile currency platform. Kik saw the same vision of a mobile peer to peer money and chat app.

But Facebook beat them to the punch with tremendous global reach, deep pockets and a consortium of corporate heavyweights who signed on as founding members of the Association, including Visa, MasterCard, Stripe, Paypal, Lyft, Ebay, Uber, Vodaphone, not to mention VC titans like Andreessen Horowitz.

Just as Amazon had the power to make their Kindle ebook reader a platform with their combination of money, tech savvy and connection to book sellers big and small, Facebook and the masters of the financial and tech world have the power to create a platform and push it into the hands of billions.

And Facebook has interfaces down cold. They know how to build a compulsively clickable social media platform and their WhatsApp chat client is one of the most widely used in the world, as is Instagram, the standard social media app for the me generation.

Facebook’s Calibra wallet will easily integrate into WhatsApp, Messenger and Facebook itself. It already looks super simple and easy to use, with the wallet sporting a clean and beautiful UI. Every single project in crypto should go out right now and spend some of their millions of dollars in ICO money on hiring a team of brilliant UI/UX developers. Otherwise it’s an extinction level event for your platform. If it’s not easy to use, it’s DOA.

Killer app solved.

Let’s move on to scale, business model and the power games of multinational corporations.

A number of writers have pointed out that Libra’s consensus system looks a lot like Proof of Stake, but it’s more accurate to say it functions like Delegated Proof of Stake, popularized by EOS and other platforms. It’s a Byzantine Fault Tolerant system based on HotStuff, a consensus system created by researchers at VMware, Cornell and UNC Chapel Hill. Basically they have a bunch of giant validator nodes that process transactions on the network, while risking their own money if they try to cheat the system.

Delegated Proof of Stake is one of the fastest consensus systems in action today, scaling to thousands of transactions per second, versus the paltry 7 of Bitcoin and 15 of Ethereum.

Of course, those big company Association members, like Visa and Mastercard, all paid $10 million dollars for the privilege of functioning as validators on the network.

Why would they do that?

Because they’re going to make a lot of money.

And that is where the business plan comes into clear focus. Facebook built a killer business model for their validators. Before any of them develop a single app for the ecosystem they will rake in money hand over fist.

Unlike other cryptocurrencies with a fixed money supply that’s slowly released over time, Libra’s currency gets created or destroyed as money comes into the system. If you exchange $50 for Libra, the equivalent amount of Libra coins are minted. If you take money out of the system, the money gets destroyed.

A number of writers pointed out the similarity to the IMF’s SDR (Special Drawing Rights) system but it’s better than SDR and goes a lot further. In fact, it’s borderline genius.

Here’s how it works. Libra is backed by a reserve of fiat money. That will work out to a beautiful ROI for the validators. Fiat money will flow in from all over the world as people change it out for Zuckbucks. The validators could hold that money, invest it, swap it and trade it. If they hold it in the traditional banking system the interest alone is enough to make their original $10 million dollars look like chump change.

In other words, the validators keep the interest and you get nothing.

Your Internet funny money won’t increase in value like many other cryptos, so you won’t get interest and you won’t get new value. That’s because the Libra coin is designed to stay stable. It won’t swing wildly like Bitcoin and the other deflationary coins because it’s pegged to a basket of currencies, like the Yen, Dollar, Euro and Pound, which means it inherits the inflationary monetary policy of central banks.

And that’s just the beginning. This isn’t just a blockchain with some stable money. In fact, it’s not even a blockchain at all despite them using the term over and over in the whitepaper. It’s a post-blockchain, federated database.

According to the paper:

“The Libra Blockchain is a cryptographically authenticated database maintained using the Libra protocol. The database stores a ledger of programmable resources, such as Libra coins. A resource adheres to custom rules specified by its declaring module, which is also stored in the database.”

It also has its own smart contract language, called Move, that looks strong and is designed to avoid the security issues of earlier smart contract systems. Even the first implementation is a good choice, written in Rust because Rust doesn’t face as many security problems as other languages due to its emphasis on safe code.

“With “safe code,” objects are managed by the programming language from the beginning to end. The developer doesn’t do any pointer arithmetic or manage memory, as can be necessary in C or C++ programs.”

But blockchain or no blockchain and new smart contract language or none, what Facebook built is a complete platform and that is what matters most and what the crypto community is missing as they build the future piecemeal.

Platform is the key word here. It all functions in perfect harmony together like a well rehearsed orchestra.

Beyond pulling in huge swaths of fiat money to earn interest, the validators will develop apps and programs to run on the system, as well as goods and services. In other words, it’s a place to buy and sell things.

That makes it a post-blockchain stablecoin, safe smart contract programmable resource manager, messaging system, and ecommerce platform in one.

Ecommerce is the essential component in the mix. Without that, all you have is monopoly money but nowhere to spend it, which is why most coins remain the darling of speculators but almost nobody buys coffee or Playstations with crypto.

If crypto projects want to gain real traction and compete with this mega-platform they need to wise up and build a real business model like what Facebook has done here.

It’s not enough to make money out of thin air if you have nowhere to spend it.

You need an interface, governance, money and things to buy and sell all rolled into one epic ecosystem.

The Return of the Dutch East Indies Company

And that brings us to one of the most interesting side effects of the Libra coin.

With a complete ecosystem and ability to drive rapid adoption across Facebook’s billions of users, it will be the first platform to really challenge the sovereignty of state sponsored money, the traditional banking system and the power of the state to print and distribute money.

Who’s not in the coalition is just as interesting as who’s in it.

No banks. Not one.

It’ll be interesting to know if any banks have back end deals with the Association. Its members will be storing a lot of money and banks will want to know the origin of that cash flow.

The choice to peg Libra to a basket of currencies is fascinating as well. By pegging it to a flurry of other currencies they’ve started the planet down the path of ditching the dollar as the default world currency.

The flip side to this argument is that it may actually cement the dollar as the world currency once and for all. As the Association mops up all the fiat in the world they’ll likely turn it into dollars on the back end anyway, so Euros and Yen become Dollars and cents.

Maybe that’s why so many regulators are looking so closely at it. Money is the ultimate in frozen concentrated power and states will not give that power up without a fight, even to the massive corporations backing this brave new coin.

It’s a war the crypto community always knew was coming but never really had the power to win. All the crypto projects to date are a rag-tag insurgency, using guerrilla tactics, staying anonymous and spreading out, but they’ve never had much of a chance standing up against the true might of the state if the state turned the eye of Sauron upon them.

In a way, Facebook just did the community a massive favor.

They’ll draw the fight away from smaller projects and Bitcoin to a more conventional enemy, a top down, hierarchical enemy. This is an enemy the state understands well. There’s nothing states love more than cutting off the “head of the snake.”

But this is no easy fight.

This is a well funded and powerful opponent. The governments of the world aren’t facing eGold, they’re facing the Association, the modern equivalent of the Dutch and British East India companies. All that’s missing is their own company armies. This isn’t some small band of brothers project, working in secret, trying to keep their Github online and their exchanges from getting shut down by hostile governments. It’s an alliance. An alliance with a war chest.

The Association behind Libra has the money and clout to write and change laws. And when their Buy n Large platform boots up, that power will grow with each passing second as more and more fiat money flows into their coffers. Any country that stands in their way will face a flurry of lobbyists and NGOs that will punish regulators and rewrite laws in their favor or starve that government of brand new wealth while other countries flourish.

It’s cyberpunk come to life. Massive multinational corporations against the power of state.

And if cyberpunk tells us anything, it’s that corporations eventually win.

The Sky Above the Port was the Color of TV Tuned to a Dead Channel

For years I’ve warned that if the crypto community didn’t move fast the big boys and governments would take their ideas and warp them to fit the status quo.

That time is now.

If you want to corrupt the free-the-money movement, the formula is simple:

Take a dash of power-to-the-people corporate marketing, like banking the unbanked:

“Reinvent money. Transform the global economy. So people everywhere can live better lives.”

Just like Pepsi selling a fight the man message so you drink more sugary sweet cola, they’ve tugged at our heart strings with all those poor 3rd world people who just can’t get a bank account and buy things.

Next you rope in the old world financial titans who’ve been patenting up the most basic and obvious ideas in the blockchain space to sue the hell out of any competitors to their global hegemony.

After that, make it simple and easy to use so that people who don’t care about trivial things like their privacy because they have “nothing to hide” will lap it up like good little lemmings.

Lastly, trim it all down with key escrow and you’ve safely shut down the crypto revolution.

Don’t worry Citizen, Facebook helpfully keeps your private keys for you so you don’t have any control over your money, just like the regular banking system!

And of course, they won’t tie your money to an ID according to the whitepaper:

“The Libra Blockchain is pseudonymous and allows users to hold one or more addresses that are not linked to their real-world identity.”

Trust us.

But we know that’s not true because “Calibra will require users to go through an intensive Anti-Money Laundering (AML) and Know Your Customer (KYC)” on-boarding for every user.

That’s just one of dozens of contradictions if you look close and read between the lines.

We have a blockchain, non-blockchain. We have a permissioned system that will “transition to a permissionless system” with no explanation whatsoever of how they will pull off that little feat. We have a currency not tied to an ID but an intensive AML process.

Just like the Indian Aadhaar “voluntary” ID system where the system wasn’t supposed to keep people’s history and link it all together, all it took was the Indian government passing a law and now they have to keep the data. Then the government followed that by making an Aadhaar ID essential to open a bank account or keep your bank account open and suddenly voluntary is mandatory and we’ve slid as far down the slippery slope as possible.

Pretty soon a centralized digital ID will be absolutely required just to use the system, all for your protection. And then companies and governments will know everything you do and everywhere you go and everything you spend your money on as they track you with advanced AI/ML algorithms.

If the dream of crypto enthusiasts was to restore self-sovereign money, they failed.

Either that or this is a major setback and the rebel alliance needs to fall back and regroup fast.

Luke lost his hand. The Empire struck back hard.

Vader is and always was your daddy.

These companies took the best ideas of the crypto community and channeled them safely back through known choke points.

Maybe you thought you were working on the hope of the future when you got into crypto? All it would take was some patience and time and you could tunnel your way out of captivity.

You didn’t realize your prison escape club was sponsored by the prison association all along.

You were just tunneling into another part of the prison.

But there’s still hope.

Proprietary platforms often take an early lead because they can do just what Facebook did, design a fabulous interface, scale fast and hurl tons of money at the problem. Eventually though, open platforms catch up. Open source software ate proprietary software in the enterprise and the cloud over the last decade. Every major innovation starts in open source now, whether that is big data, or cloud, or AI.

Open projects are slow moving, made by rebels and misfits standing against the galactic empire. They start off ugly but eventually find their way through a slow evolution that wins out over the directed evolution of proprietary systems.

At least that’s what I keep telling myself.

It doesn’t always work out that way.

Apple builds walled gardens that work surprisingly well and it made them the biggest company in the world.

Sometimes the rebel alliance pulls it out at the last minute, just like in the movies, but sometimes the empire wins.

It’s hard not to get depressed the more I look at Libra.

It’s everything I wanted for the crypto community, scalability, usability and a robust ecosystem of merchants and businesses supporting it with their hard earned money. They even built in a secondary investment coin for their corporate titans, basically a deflationary coin that rewards their oligarchy, and gamified money, because validators can give away Libra as rewards, just like I’ve been pushing for years.

And yet it’s everything that we should hate and fear.

Panopticon money. Lack of control. Identities linked to everything we do so that companies know where we live, where we shop, who we’re sleeping with, who we’re friends with and more. They can track our digital and real life right down to the nanosecond. And they can see through your wallet like Superman seeing through walls and into your past, present and even into your future with predictive analytics. They will control the flow of money and make or break businesses, communities and geographies.

https://hackernoon.com/libra-a-cyberpunk-nightmare-in-the-midst-of-crypto-spring-5543b6f6e34b