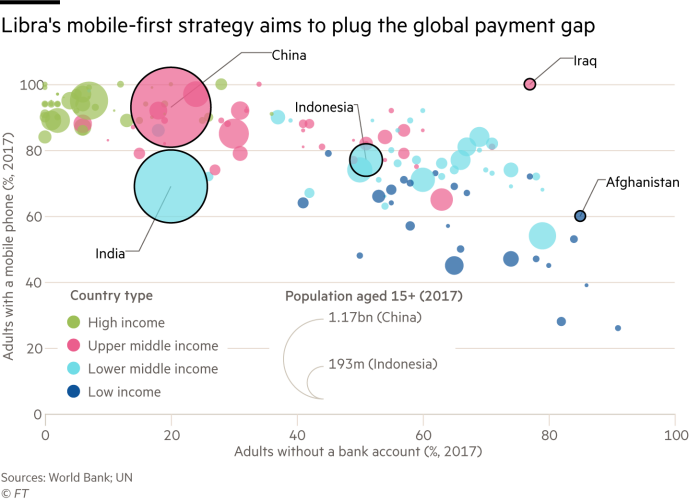

Banks steer clear of Facebook’s Libra project Traditional lenders are working on their own faster, cheaper payments projects Facebook’s Libra threatens to break down banks’ role as gatekeepers of the global financial system © FT montage Share on Twitter (opens new window) Share on Facebook (opens new window) Share on LinkedIn (opens new window) Save Save to myFT Laura Noonan and Robert Armstrong in New York, Nicholas Megaw and Stephen Morris in London 12 HOURS AGO Print this page41 US and European banks are steering clear of Libra, Facebook’s project for a new cryptocurrency, for fear of antagonising regulators and cannibalising their own digital currency projects In the two weeks since Facebook announced its plans for a new digital currency, there has been silence from the banks about a project that threatens to break down their role as gatekeepers of the global financial system. “We’re still learning what it is and trying to work out where we stand on it; are we an opponent, partner or do we ignore?,” said a person familiar with the approach to the project of one of the world’s biggest banks. Up and down Wall Street, the City of London and Europe’s financial centres, senior industry executives reel off a litany of hurdles to participation, while some also criticise the way Facebook has approached the project so far. No banks were on the initial list of 27 other partners for the Libra Association, which will oversee the currency, though David Marcus, who is leading the project at Facebook, said he wanted to “absolutely and strongly deny the fact that we’ve approached banks and banks have said no”. “We have had conversations with banks. We still have conversations with banks. And my expectation is that by the time this thing launches next year you will have banks that are going to be members of this,” he told the Information. Senior executives at banks, however, tell a different story. At least one bank, the Netherland’s ING, responded to Facebook’s initial contact with a polite “no thank you”. Several other senior executives said there would be big hurdles for their future involvement, either as active members of the Libra Association or by helping people to convert traditional money in and out of Libra coins. Mike Corbat, head of Citigroup, recently said that even though he was a “true believer” in cryptocurrencies and their underlying blockchain technology, Citi’s capacity to participate is constrained, “The challenge with cryptocurrencies is the opaqueness as to the sources of the money,” he said, referencing anti-money-laundering standards banks are held to. “It would be outside our ability to take or send those monies on behalf [of people who hold them].” Facebook’s Libra coin: the truth behind the hype Meanwhile, several banks are pushing ahead with projects to speed up payments, which some said would overtake the Libra initiative. Mastercard, which is part of the Libra project, is working with six Nordic banks to build a payments system that would allow real-time transfers, and be used across multiple currencies in multiple countries. Paul Stoddart, Mastercard’s president of new payment platforms, said he expected to see “more initiatives like this around the world where there are groups of countries or regions that are economically more tightly integrated”. In the US, The Clearing House, a payments company backed by a coalition of 25 large banks including JPMorgan Chase, Bank of America and Citigroup, offers domestic real-time payments on a network, launched in 2017, that already connects half of the country’s deposit accounts. And on June, 13 of the world’s biggest banks including UBS, Lloyds Banking Group and MUFG, announced plans to launch their own digital coin for use in wholesale banking. Recommended Libra: Facebook’s digital currency Will Facebook’s Libra currency shake up financial services? A senior executive at one of the banks involved said: “Facebook is right that cross-border payments are clunky and convoluted and you have to go through far too many counterparties, but banks are getting involved and will solve this problem and solve it pretty quickly.” The banks expect that the first institutional transaction with the “universal settlement coin” will take place within a year, and could be a cross-border trade. Meanwhile, the head of innovation at another US bank said the industry needed to understand a lot more, including the purpose of the Libra coin, the regulatory environment and the system’s technical underpinning before they could commit to the project. “We will be talking to them [Libra] very soon,” he said. “There’s a huge amount of scepticism but there’s some enormous names who have put up $10m a pop; there’s enough names of enough reputable organisations that have put up $10m to be a part of it to say there’s something there.” A senior executive at a third large US bank said he did not believe banks would have to lobby very hard to ensure that Libra attracts the same know-your-customer and anti-money-laundering scrutiny as traditional payments networks, which will heap costs on the project. “If this thing has the scale of 2bn people who can move money around outside of the financial system (without AML/KYC), it makes a mockery of the system,” he said. “We won’t have to persuade them in Washington . . . regulators are at it, they’ll make them lift to the same standards as everyone else.” The executive added that Facebook, which recently hired a prominent lobbyist from Standard Chartered, had already mishandled the regulatory piece by announcing their plans without having first brought regulators onside. Who is backing Libra so far? Payments Mastercard, PayPal, PayU, Stripe, Visa Tech and consumer Booking Holdings, eBay, Facebook, Farfetch, Lyft, Mercado Pago, Spotify, Uber Telecoms Iliad, Vodafone Blockchain Anchorage, Bison Trails, Coinbase, Xapo Holdings Venture Capital Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, Union Square Ventures NGOs Creative Destruction Lab, Kiva, Mercy Corps, Women’s World Banking When JPMorgan Chase drew up plans for a much more limited digital coin, they had extensive conversations with regulators before going public, asking them for informal guidance on what would be acceptable to them, a person close to that process said. The Trump administration’s financial regulation regime is much more amenable to those iterative conversations than the Obama administration, which “saw banks as the enemy”, he added. The head of innovation of a large European bank said its participation was hampered by the fact that “regulations don’t allow us to be very entrepreneurial in this area”. Mr Marcus acknowledged the regulatory concerns in a blog post on Wednesday. He promised a “collaborative process” with regulators, and said replacing cash with a digital network “with regulated on and off ramps with proper know-your-customer practices” could help limit financial crime. A senior executive at a fourth large US bank said his company might still participate but there was a long road ahead. “The money [initial $10m investment] over here wouldn’t be the most material hurdles, they [the sums] are not big among in the scheme of things,” he said. The test would be whether it is “regulated, and is it really solving a problem or just ticking a quasi-innovation box, we’d need to be comfortable with the use cases, what they would do beyond regulation, regulation is like a minimum bar”. For some banks, even ticking all those boxes will not go far enough. “You could argue it’s a competitor to our competitive advantage . . . the ability to move money around the world for customers within our network. So it would be rather unusual to go outside that, to compete against yourself, in many ways.”

Source: Banks steer clear of Facebook’s Libra project | Financial Times